Bad Debts Written Off Journal Entry

Since the tax is payable regardless of collection status the debt is written off with the following journal entry. Decides to write off accounts receivable of Mr.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

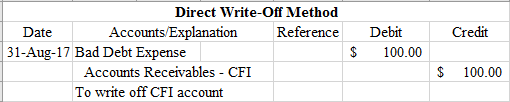

A bad debt can be written off using either the direct write off method or the provision method.

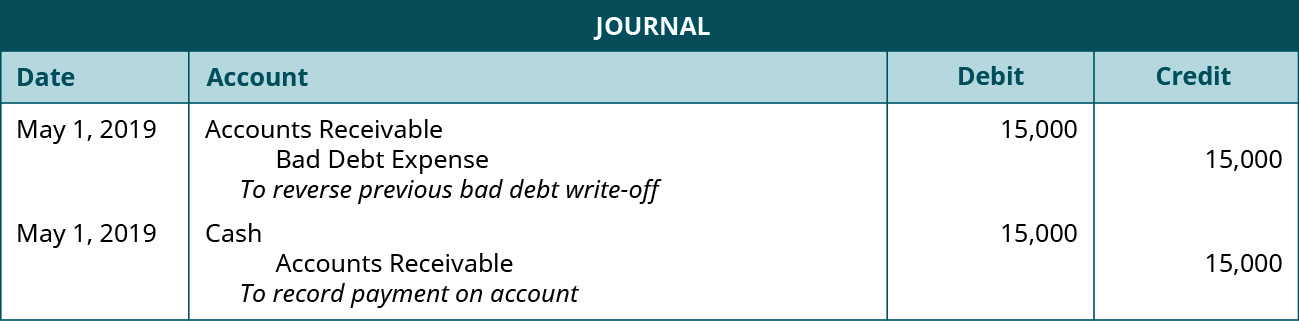

. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered. It is simply a loss because it is. August 21 2022.

After the journal entry is made Sales still records. When an account receivable is. A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year.

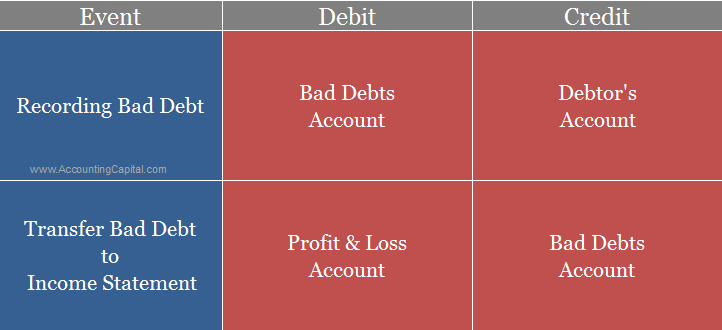

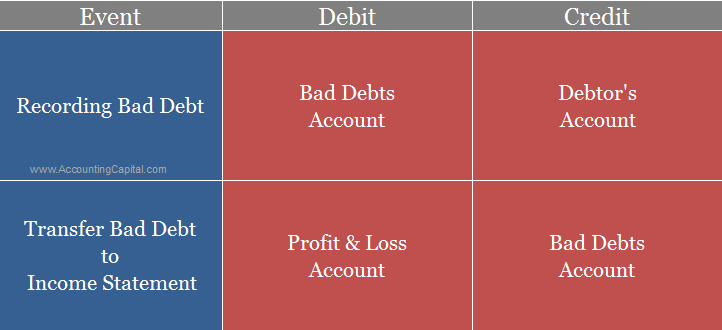

Create a journal entry to credit the amount of the unpaid invoice to your accounts receivable account. When an amount becomes irrecoverable from debtors the amount is debited to the Baddebts account and credited to the personal account of. Bad Debts Ac Dr.

For example the company XYZ Ltd. Note the absence of tax codes. We and our partners store andor access information on a device such as cookies and process personal data such as unique identifiers and standard information sent by a device for.

3 Make write-off against the allowanceAllowance for the bad debt already exists in the accounting record. Journal entry to record the write- off of accounts receivable February 9 2018 April 12 2021 accta Q1 The entity concludes that 1200 of its accounts receivable cannot be collected in the. However on June 12 2021 Mr.

So when its time to make a write-off we can use allowance without. Bad debts is a loss for the organization and should be debited to profit loss. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10.

Z that has a balance of USD 300. Journal Entry for Bad Debts Written Off Written off means we are closing bad debt account by transferring bad debt amount to the debit side of our profit and loss account. When the company has enough evidence to write off the bad debt the accountant will seek approval from the management to write off the accounts receivable as bad debt.

1 day ago Bad Debts. The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. The first approach tends to delay recognition of the bad debt.

A sum of 2000 earlier written as bad debts is. Bad debts has to be debited as an expenseloss and credited to sundry debtors account. To accurately write off bad debt for an invoice you must do the following.

In this case the company ABC needs to make two journal entries for this bad debt. Already has 7000 in the provision for doubtful debt accounts from. D paid the 800 amount that the company had previously written off.

A bad debt situation occurs when money that is owed cannot be recovered. You can apply for bad debt relief from the Comptroller of GST for return of the. Provision for doubtful debts.

Bad Debt Overview Example Bad Debt Expense Journal Entries

What Is The Journal Entry For Bad Debts Accounting Capital

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

Writing Off An Account Under The Allowance Method Accountingcoach

Comments

Post a Comment